If you’ve been in a crash in Rancho Cucamonga or anywhere in Southern California, you already know how fast a “simple” accident turns into a mess. One driver was speeding. The other merged a little too tight. Someone hesitated at a light. Then the question hits hard:

“If I was partially at fault, do I lose my right to compensation?”

In California, most of the time the answer is no. Even if you made a mistake, you can still pursue compensation. The key detail is this: your final recovery is reduced by your share of fault.

California follows a rule called pure comparative negligence, adopted by the California Supreme Court in Li v. Yellow Cab in 1975.

Key takeaways

- You can still recover damages even if you’re mostly at fault, but your compensation is reduced by your percentage of blame.

- Fault percentage becomes the whole fight, because every 10% added to you is 10% less the insurer wants to pay.

- Principally at fault for insurance purposes is commonly treated as 51%+, and California regulations also include rules for how insurers can make that call.

- You may need to file an SR-1 with the DMV within 10 days if there’s any injury (even minor) or property damage over $1,000, regardless of fault.

- Two extra California rules can change the money: Prop 51 (how pain and suffering is split) and Prop 213 (limits for uninsured drivers).

California’s “pure comparative negligence” rule, in plain English

California’s system works like this:

- You can still recover damages even if you were partly responsible

- Your recovery is reduced by your percentage of fault

- There’s no cutoff like, you must be under 50% (some states have that, California does not)

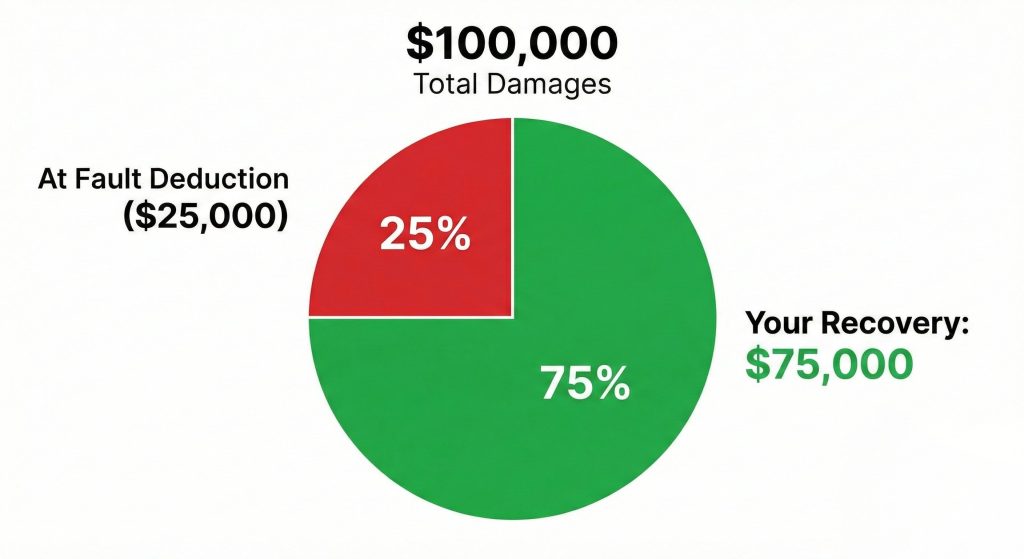

The simple math

Recoverable amount = Total damages × (1 − your fault percentage)

Here’s what that looks like with real-world style numbers:

Total damages | Your fault | Estimated recovery |

$100,000 | 25% | $75,000 |

$50,000 | 70% | $15,000 |

$200,000 | 10% | $180,000 |

That middle example surprises people, but it’s real in California: mostly at fault doesn’t automatically mean get nothing.

Why your fault percentage becomes the whole battle

In theory, comparative negligence is fair. In practice, insurance companies know exactly what they’re doing:

Every 10% of fault they stick on you cuts what they pay by 10%.

So when you hear things like:

- “You were probably speeding a little…”

- “You didn’t react fast enough…”

- “You should’ve seen them coming…”

That’s not casual conversation. That’s positioning.

The real-world cost is bigger than just your injury claim

If you’re labeled at fault, it can also hit your auto insurance costs. Bankrate’s national analysis shows that a single at-fault accident can raise premiums by about 43% on average (depending on coverage level, state, and driver profile).

And in California specifically, Bankrate has also reported scenarios where the increase can be even higher depending on the factor being rated.

The “51% rule” people talk about (and what it really means)

You’ll hear a lot of people say: “If I’m 51% at fault, I’m screwed.”

For your injury claim, that’s not true in California. You can still potentially recover something under pure comparative negligence.

But for insurance rating, principally at fault matters. California regulations describe how insurers determine whether a driver is principally at fault, including the 51%+ concept and thresholds tied to injury/death or property damage amounts.

Why this matters: insurers may push hard to frame you as the main cause, because it can affect both what they pay you and how they treat the claim overall.

How fault is actually decided in California accident claims

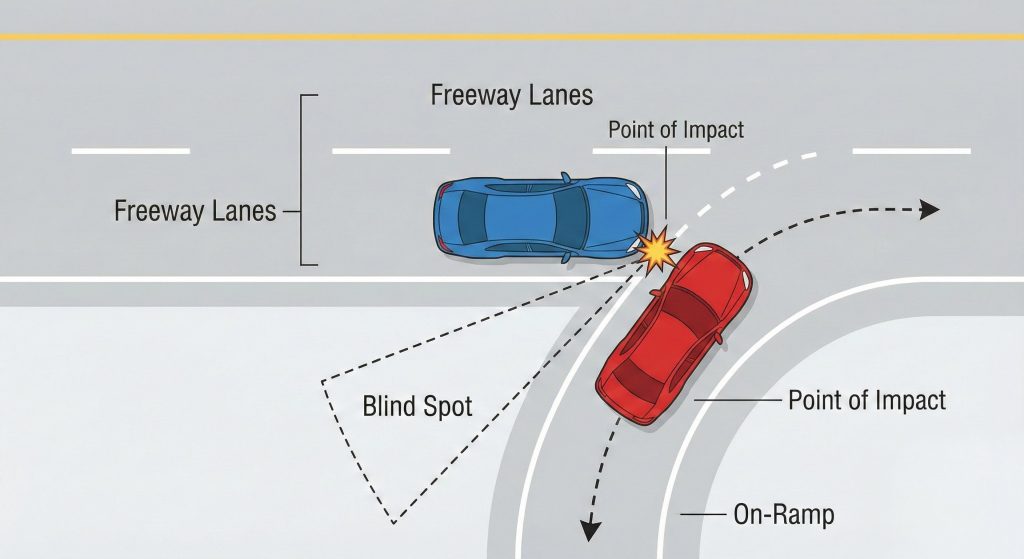

Fault usually isn’t decided by one thing like who got the ticket. It’s decided by evidence that answers questions like:

- Who had the right of way?

- What traffic laws were broken?

- Did the mistake cause the crash, or just make the injuries worse?

- Could the collision have been avoided with reasonable driving?

Insurance companies commonly use:

- photos of the scene, damage patterns, skid marks, lane arrows

- the police report (helpful, not always final)

- witness statements

- video (dashcam, business cameras, traffic cameras)

- phone records in distracted driving cases

- accident reconstruction in major injury cases

This is why Rancho Cucamonga accident liability disputes feel so frustrating: the truth is usually in the details people forget to document.

Common partial fault arguments insurers use

These show up constantly in Southern California crashes, especially on the 210, 10, and 15 where merges get tight fast:

- You were speeding. Even small allegations get used to bump your percentage.

- Unsafe lane change. A classic fight in heavy freeway traffic.

- Failure to yield. Left turns and yield signs are battlegrounds.

- You stopped too suddenly. Rear-end crashes are not always automatically 100% the back driver’s fault.

- Distraction. Even hands-free phone use can get framed negatively.

- Seatbelt. This can be used to argue injuries were worse than they otherwise would have been.

None of these automatically makes you mostly at fault, but if you don’t protect evidence early, the story can harden against you.

What to do right away if you might share some blame

If you only take one thing from this post, let it be this: don’t accidentally build the case against yourself.

Here’s a clean checklist you can follow:

- Get medical care quickly. It protects your health and creates a record linking injuries to the crash.

- Don’t apologize or guess about fault at the scene. You can be kind without saying “This was my fault.”

- Take more photos than you think you need. Wide shots, close-ups, signs, lane arrows, lighting, weather, debris, skid marks.

- Get witness contact info. Names, numbers, and one sentence about what they saw.

- Be careful with recorded statements. If you’re unsure, don’t let an adjuster pressure you into a rushed narrative.

- File the SR-1 when required. California generally requires an SR-1 within 10 days if anyone is injured (even minor) or property damage is over $1,000, regardless of who caused the crash.

Two California rules that can change the money in shared-fault cases

1) Prop 51: pain and suffering is split by fault

Under Civil Code 1431.2 (Prop 51), non-economic damages (like pain and suffering) are generally allocated to each defendant in proportion to their fault, rather than being fully collectible from one party. That can matter a lot in multi-party cases (think: employer vehicles, rideshare, multiple drivers).

2) Prop 213: uninsured drivers may be limited

California’s “No Pay, No Play” rule (Civil Code 3333.4, tied to Prop 213) can limit an uninsured driver’s ability to recover non-economic damages in many auto cases. This doesn’t always mean you get nothing, but it can change what’s realistically available.

When it’s smart to talk to a lawyer (especially in Rancho Cucamonga fault disputes)

If any of these are happening, getting help early usually saves money and stress later:

- The insurer is pushing hard that you’re mostly at fault

- You were cited, but you disagree with what happened

- Injuries are serious, ongoing, or need specialist care

- Multiple parties are involved (rideshare, employer vehicle, unsafe road design)

- There’s video evidence that could be overwritten or lost quickly

- You’re worried the adjuster is twisting your words

A good attorney, such as the Muhareb Law Group, can gather the right proof, push back before blame gets baked in, and keep the fault percentage tied to the actual evidence.

A final note if you’re feeling stuck in that “maybe this was my fault” spiral

It’s understandable how heavy this feels. Most people aren’t trying to be reckless. Roads are chaotic, and a lot of crashes happen in the gray areas. But you still deserve a fair fault assessment based on what actually happened, not what an adjuster wants to believe happened.

If you’re dealing with a partial fault accident in California and you want to protect your claim, a simple next step is to talk with a local injury team that handles comparative negligence laws and Rancho Cucamonga accident liability disputes.

FAQ: Partial Fault Accidents In California

1. Can I still sue if I’m partially at fault in California?

Yes. California’s pure comparative negligence system allows recovery even when you share blame; your compensation is reduced by your percentage of fault.

2. What if I’m more at fault than the other driver?

You can still potentially recover something in California as long as someone else’s negligence contributed to the crash.

3. Do I have to report the crash to the DMV?

In many cases, yes. You generally must file an SR-1 within 10 days if anyone is injured or property damage is over $1,000, regardless of fault.

4. What if the crash damages are bigger than insurance coverage?

This is getting more common. California’s minimum liability limits increased beginning January 1, 2025 to 30/60/15 (up from 15/30/5), rolling in as policies renew.